Features Of Money Laundering Act

The Act extends to whole of India except JK. Features of Money Laundering.

Modeling The Money Launderer Microtheoretical Arguments On Anti Money Laundering Policy Sciencedirect

In the following the main features of the draft law will be summarized and explained.

Features of money laundering act. To provide for the sharing of information by the Centre and supervisory bodies. Prevention of Money Laundering Act 2002 was enacted to fight against the criminal offence of legalizing the incomeprofits from an illegal source. AMLA applies if a person or entity is entitled to dispose of funds or other assets and thus acts as a so-called financial intermediary.

117 of 27 February 2006 with amendments consequential upon section 6 of Act no. Features of Money Laundering Money laundering means billions of pounds and dollars a year are laundered through our financial systems. Salient features Provision of Punishment for money-laundering.

Features of Money Laundering Money laundering means billions of pounds and dollars a year are laundered through our financial systems. The Act expressly states that where a person is found guilty of money-laundering in India he shall be punished with rigorous imprisonment from 3 to 7 years and where the proceeds of guilt involved relate to any offence mentioned under paragraph 2 of Part A of the Schedule Offences under the Narcotic Drugs and Psychotropic. 9160 The Anti-Money Laundering Act AMLA of 2001 a.

Some other features are as follows. Currently the provision of pure advisory services is not subject to the Anti-Money Laundering Act. PREVENTION OF MONEY LAUNDERING ACT 2002 came into force with effect from 01st July 2005.

Duty to report international transfer of funds and securities. WHEREAS the Political Declaration and Global Programme of Action annexed to the resolution S-172 was adopted by the General Assembly of the. 1 Obliged entities shall apply customer due diligence measures pursuant to Sections 10 to 20 and conduct ongoing monitoring pursuant to Section 24 on the basis of an assessment of the risk of money laundering and terrorist financing.

Limitation to make or accept cash payment. An Act to prevent money-laundering and to provide for confiscation of property derived from or involved in money-laundering and for matters connected therewith or incidental thereto. Creates a Financial Intelligence Unit FIU.

Act Subsidiary Legislation ACT Acts 8 of 2010 9 of 2011 13 of 2013 Statutory Instrument 1442012. This is because in India stashing black money is simply a civil crime involving tax evasion while money laundering has criminal dimensions related to black money. Introduction of Advisors as a new category of persons subject to AMLA.

Act on Measures to Prevent Money Laundering and Financing of Terrorism. Salient Features of RA. The methods used to launder money are similar whether its for white-collar crimes such as tax evasion peopledrug trafficking or proceeds from fraud and internet scams.

MONEY LAUNDERING PREVENTION ACT Revised Edition Showing the law as at 31 December 2013 This is a revised edition of the law prepared by the Law Revision Commissioner under the authority of the Revised Edition of the Laws Act. Provides for freezing seizure forfeiture recovery of dirty money property. The Act provides for separate provisions bearing on attachment associate.

This is an Act to consolidate the Danish Act on Measures to Prevent Money Laundering and Financing of Terrorism cf. PMLA Amendment Act 2012 has enlarged the definition of money laundering by including activities such as concealment acquisition possession and use of proceeds of crime as criminal activities. Directorate of Enforcement of the Department of Revenue Ministry of Finance.

PART 1 PROHIBITION OF MONEY LAUNDERING 1. To provide for the issuance. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules.

108 of 7 February 2007 and section 8 of. MONEY LAUNDERING PROHIBITION ACT 2011 ARRANGEMENT OF SECTIONS SECTION. The Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the 2010 Act and transposes the Fifth Anti-Money Laundering Directive 5AMLD into Irish law.

The following is a summary of the most significant changes to the AML legal landscape including. The Anti-Money Laundering Act. 442 of 11 May 2007.

Act in relation to other laws. The Act extends to whole of India except JK. Features of money laundering act.

Money laundering is the process by which large amounts of illegally obtained is given the appearance of having originated from a legitimate source. To provide for risk management and compliance programmes governance and training relating to anti-money laundering and counter terrorist financing. 9160 as amended by RA.

The risk shall be assessed in view of inter alia the purpose of the customer relationship the amount of customer funds. In Money laundering the black money must involve a predicate crime such as the violation of Indian Penal Code IPC Narcotics Prevention of corruption and Human Trafficking. To prevent money- laundering seize the property with authority involved in money laundering.

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Art Market In The Frame Of Money Laundering

Shell Companies And Money Laundering How To Combat Them

What Is Money Laundering And How Is It Done

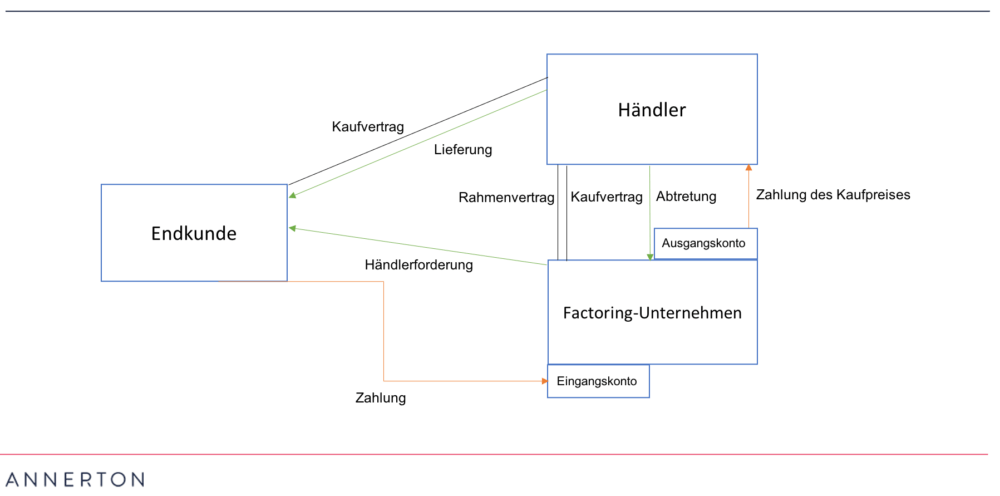

Factoring And Anti Money Laundering Law

Combating Money Laundering Using An All Crimes Approach New Law In Germany Aims To Improve The Fight Against Money Laundering

Money Laundering Video Presentation Youtube

Combating Money Laundering Using An All Crimes Approach New Law In Germany Aims To Improve The Fight Against Money Laundering

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

How Money Laundering Works Money Laundering Budgeting Money Finance Investing

Eu Policy On High Risk Third Countries European Commission

Money Laundering How Do Banks Detect Criminal Activity N26

Combating Money Laundering Using An All Crimes Approach New Law In Germany Aims To Improve The Fight Against Money Laundering

What Are The Three Stages Of Money Laundering

Red Hat Enterprise Open Source Anti Money Laundering Solution

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Post a Comment for "Features Of Money Laundering Act"