What Does A Money Laundering Check Involve

Money laundering placement is the process of placing unlawful proceeds into financial institutions through deposits wire transfers or other means. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

In the show it is obvious that they dont have much choice initially.

What does a money laundering check involve. The sheer size of the market and the high value of property assets means that extremely large sums can be cleansed in a single transaction. What is Money Laundering. The popular show Ozark is all about a family who launders money for a drug cartel.

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. Because the objective of money laundering is to get the illegal. HMRC may check the compliance of your business using visits or office based compliance if its registered under the Money Laundering Regulations.

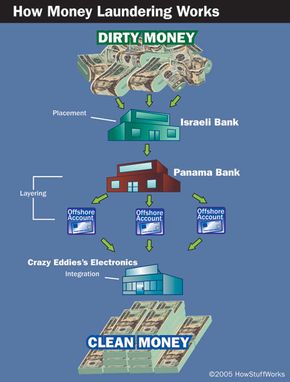

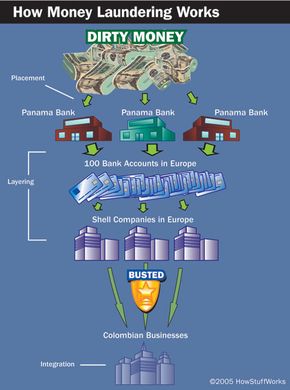

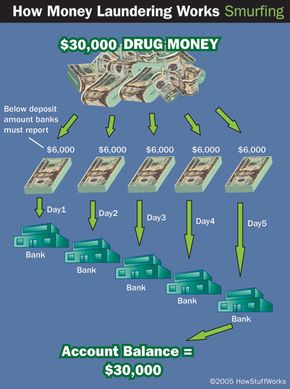

Money laundering involves hiding your criminal profits by making the money look legitimate. Its nothing to do with money laundering thats just what they tell the hoi poloi. The layering often involves passing the money through multiple transactions accounts and companies it may pass through a casino to be disguised as gambling winnings go through one or more foreign currency exchanges be invested in the financial markets and ultimately be transferred to accounts in offshore tax havens where banking transactions are.

Checks on your identity will require you to produce some photographic evidence like a driving licence or a passport. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

Its well-known that money laundering can often involve foreign banks and legitimate businessesso how do banks actively prevent money laundering from happening. A simpler definition of money laundering would be a series of financial transactions that are intended to transform ill-gotten gains into legitimate money. Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion.

When they make money criminals need to disguise how and why it came into their hands. Money laundering is a process which criminals use to make it look like the money they have is legitimately earned. It says those service providers who offer for example the replacement of nominee directors or registered offices are most at risk.

Lets look at how laundering money works and what happens if you are caught in the act of money laundering. The money is placed into the financial system through banks casinos shops and other businesses in the placement stage. In most cases these checks will be completed in the background using electoral data.

When buying a house your conveyancing solicitor estate agent and mortgage lender will carry out money laundering check to see evidence of your deposit usually in the form of a mortgage in principle or a bank statement that highlights the funds. Checks on the money are a little harder but essentially they just want to know that the money came to you legitimately and that someone somewhere gave the government their cut along the way. This phase can involve various types of transactions like breaking up large amounts of money into smaller sums and depositing them directly into bank accounts transporting cash across borders to deposit the money.

Where does money laundering occur. What theyre doing is taking dirty money and effectively cleaning it. Estate Agents And Money Laundering Checks The property market has long been recognised as an effective way through which criminals may launder the proceeds of their criminal activity.

Money laundering is a technique used by criminalsfrom mobsters drug traffickers terrorists to corrupt politiciansin order to cover their financial tracks after illegally obtaining money. Generally money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programmes. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world.

According to the NRA money laundering investigations often see the use of trusts and companies as vehicles to hide beneficial ownership.

Us Senate Passes Defense Bill With New Anti Money Laundering Measures Thomson Reuters Institute

Money Laundering Define Motive Methods Danger Magnitude Control

How Money Laundering Works Howstuffworks

How Money Laundering Really Works Casino Org Blog

Is There Money Laundering In My Real Estate Sale

Understanding Money Laundering European Institute Of Management And Finance

Five Ways To Protect Your Business From Money Laundering

Anti Money Laundering Overview Process And History

Money Laundering Meaning And Definition Tookitaki Tookitaki

How Money Laundering Works Howstuffworks

How Money Laundering Works Howstuffworks

Anti Money Laundering Overview Process And History

How Money Laundering Works Howstuffworks

How Money Laundering Works Howstuffworks

Colorado Money Laundering Laws Explained By Defense Lawyers

How The New Anti Money Laundering Rules Effect Buying Selling Real Estate Anita Dobson Kieran Barakat

What Is Money Laundering Definition Techniques Examples Video Lesson Transcript Study Com

Post a Comment for "What Does A Money Laundering Check Involve"