What Is Money Laundering Regulations 2017

20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. Money Laundering Regulations 2017.

The Money Laundering Regulations 2019 Vinciworks Blog

Regulations 2017 define an HVD as a firm or sole trader who by way of business trades in goods including an auctioneer dealing in goods when the trader makes or receives in respect of any transaction a payment or payments in cash of at.

What is money laundering regulations 2017. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. What do they mean for CDD. If not has it registered with an anti-money laundering AML supervisor.

Money laundering regulations 2017 high value dealers. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. Its a course of by which soiled cash is transformed into clean money.

The 2017 Regulations require firms in the regulated sector to implement AML compliance programs with the following components. As a result money laundering regulations are strict and regularly updated. Money Laundering Regulations 2017.

The new regulations known as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations MLR 2017 replace the Money Laundering Regulations 2007 and the Transfer of Funds Information on the Payer Regulations 2007 MLR 2007. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued.

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. These Regulations replace the Money Laundering Regulations 2007 SI.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. What are the Three Stages of Money Laundering. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Obtain records of all relevant customer interactions. ICAEW is the automatic supervisory authority for ICAEW member firms. 20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The Regulations contain detailed procedural anti-money. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws.

Suddenly there is a sense of urgency around the UKs implementation of the fourth Money Laundering Directive MLD4. The relevant requirements demand that those operating within the regulations undertake certain activities and refrain from undertaking others unless the proper. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise.

The sources of the money in actual are felony and the money is invested in a approach that makes it appear to be clear cash and conceal the identification of the felony part of the cash earned. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. Money Laundering Regulations 2017.

Anti Money Laundering 2021 Laws And Regulations Iclg Anti Money Laundering Law Money Laundering Financial Institutions

27 Informative Money Laundering Statistics In 2021

Aml Screening How It Might Infiltrate Your Business

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued By Cima Money Laundering Fund Cayman Islands

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued Money Laundering Fund Management Compliance

Service Blueprint Anti Money Laundering Law Money Laundering

Anti Money Laundering 2021 Laws And Regulations Usa Iclg

Anti Money Laundering Software Market Insights Latest Technology Update Global Demand Client Analysis Money Laundering Latest Technology Updates Marketing

Money Laundering Cases Money Laundering This Or That Questions Probe

June 26 2017 Is Coming Up Fast This Is The Full Implementation Date For The Fourth Anti Money Laundering Directive Amld 4 A Ke Money Laundering Money Anti

Get Our Sample Of Anti Money Laundering Policy Template Policy Template Money Laundering Strategic Leadership

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Cryptocurrency Money Laundering Explained Bitquery

The History Of Money Laundering Kyc Chain

Anti Money Laundering Regulations In Turkey Criminal Law Turkey

Title Practical Guide To Money Laundering Act 2002 Author Kiron Prabhakar Publisher Bloomsbury Publishing 1st Edit Money Laundering Vora Criminal Law

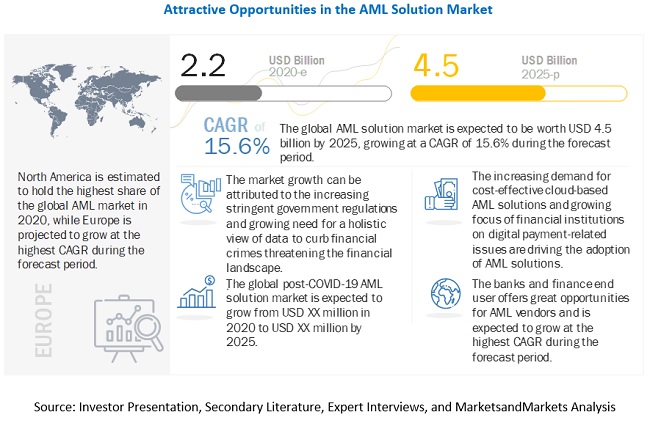

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Anti Money Laundering What It Is And Why It Matters Sas

How Anti Money Laundering Legislation Could Impact The Art Market Art Market Money Laundering Art For Sale

Post a Comment for "What Is Money Laundering Regulations 2017"